Director Independence. Each of numerous cloud based private software companiesour directors, other than Savneet Singh and serves in an advisory capacity to certain private equity firms. From April 2001 to October 2013, Mr. Tyler was the President, CEO and member ofKeith E. Pascal, has been determined by the Board of Directors of Lanyon, Inc. which provides cloud-based software for the meeting and events industry and transient hotel programs. Lanyon was acquired by Vista Equity Partners in December 2012. Prior to joining Lanyon, Mr. Tyler served as the Chief Financial Officer, General Counsel and member of the Board of Directors of a wholly owned subsidiary of CenterPoint Energy (formerly known as Reliant Energy, Inc.) from April 2000 to March 2001. Mr. Tyler is an attorney and a member in good standing of the State Bar of Texas and is also a financial expert within the meaning of the rules of the Securities and Exchange Commission. Mr. Tyler brings to the Board his financial reporting and risk management proficiencies, global hospitality technology experience, as well as a solid background in strategic planning and executive and organizational development. Mr. Tyler serves as the Chair of the Nominating/Corporate Governance Committee and as a member of the Audit and Compensation Committees. Mr. Tyler has been a Director since July 28, 2014.

EXECUTIVE OFFICERS

The following tables list all persons who served as executive officers of the Company during all or part of 2015, and all persons serving as executive officers in 2016, their respective ages as of April 8, 2016, positions held by such persons and occupations for the last five years. All of the current executive officers of the Company are serving open ended terms. There is no arrangement or understanding between any executive officer and any other person pursuant to which the executive officer was selected.

| Name | Age | Positions held |

| Matthew R. Cicchinelli (1)

| 53 | ·President, PAR Government Systems Corporation and Rome Research Corporation

·Vice President, ISR Innovations, PAR Government Systems Corporation

|

| Viola A. Murdock (2)

| 60 | ·Vice President, General Counsel & Secretary, PAR Technology Corporation

|

| Karen E. Sammon (3)

| 51 | ·President and Chief Executive Officer, PAR Technology Corporation

·President, ParTech, Inc.

|

| Matthew J. Trinkaus (4)

| 33 | ·Corporate Controller, Chief Accounting Officer and Acting Treasurer, PAR Technology Corporation

|

(1) | Mr. Cicchinelli was named President, PAR Government Systems Corporation and Rome Research Corporation effective December 15, 2015. Mr. Cicchinelli, joined PAR in 2011 as Executive Director for Operations, and in 2013 was promoted to Vice President, Intelligence, Surveillance and Reconnaissance (“ISR”) Innovations. Prior to joining PAR, Mr. Cicchinelli served in various senior roles with the United States Marine Corps and the Department of Defense with a focus on command and control, ISR technologies, and strategic plans and policies. Mr. Cicchinelli retired from the Marine Corps in 2011 with the rank of Colonel. |

(2) | Ms. Murdock was named Vice President, General Counsel & Secretary of the Company effective September 17, 2014. Prior to her promotion Ms. Murdock served as Senior Corporate Counsel since 1996 and Acting Secretary since 2013. Ms. Murdock has advised the Company of her intent to retire from the Company in 2016. |

(3) | Ms. Sammon was named President and Chief Executive Officer of the Company effective January 1, 2016. Ms. Sammon served as President, ParTech, Inc. from April 2013 until the time of her promotion. |

(4) | Mr. Trinkaus was named Chief Accounting Officer effective March 31, 2015 and Acting Treasurer effective January 1, 2016. A Certified Public Accountant, Mr. Trinkaus holds this position concurrent with the position of Corporate Controller which he has held since January 1, 2015. Mr. Trinkaus joined the Company in January of 2013, as Assistant Corporate Controller. Before joining the Company, Mr. Trinkaus served as Vice President, Assistant Corporate Controller with NBT Bancorp, beginning in November 2011. From April 2010 to November 2011, Mr. Trinkaus worked as a Senior Audit Associate with KPMG LLP. |

The following lists those Executive Officers who served in that capacity during all or any part of 2015 but have separated from the Company prior to April 8, 2016.

| Name | Age | | Positions |

| Michael S. Bartusek (1)

| 47 | | Vice President, Chief Financial Officer |

| Ronald J. Casciano (2)

| 62 | | Chief Executive Officer, President and Treasurer, PAR Technology Corporation |

| Lawrence W. Hall (3)

| 56 | | President, PAR Springer-Miller Systems, Inc. |

| Robert P. Jerabeck(4)

| 60 | | Vice President and Chief Operations Officer |

| Stephen P. Lynch (5)

| 59 | | President, PAR Government Systems Corporation and Rome Research Corporation |

| Steven M. Malone (6)

| 35 | | Vice President, Corporate Controller and Chief Accounting Officer, PAR Technology Corporation |

(1) | Mr. Bartusek was terminated from the Company for cause effective March 14, 2016 in connection with unauthorized investments made in contravention of the Company’s policies and procedures involving Company funds. Mr. Bartusek served as Vice President and Chief Financial Officer of the Company from July 20, 2015 until his termination. Prior to joining the Company, Mr. Bartusek served as the Chief Financial Officer and Corporate Treasurer at Sutherland Global Services, Inc. (“SGS”) a $900M business process outsourcer, from 2007 to October 2014. Prior to SGS, Mr. Bartusek was Director of Finance for the North American operations at XEROX Global Services, Inc. from 2004 to 2007. |

(2) | Mr. Casciano retired from the position of Chief Executive Officer and President of the Company effective January 1, 2016 but continues in the capacity of Director for the Company and subsidiary companies within the Government Business segment. A more detailed biography for Mr. Casciano can be found above in connection with Director Nominees. |

(3) | Mr. Hall separated from the Company in November 2015 in connection with the Company’s divestiture of the hotel and spa technology business unit. Mr. Hall had served as President, PAR Springer-Miller Systems, Inc., a wholly owned subsidiary of the Company and part of the Company’s Hospitality business segment since August 2008. |

(4) | Mr. Jerabeck separated from the Company on April 15, 2015 when the Company eliminated the position of Chief Operating Officer. Mr. Jerabeck had served as Executive Vice President and Chief Operating Officer of the Company since April 2013. Prior to joining the Company, Mr. Jerabeck, held various positions with a unit of Honeywell International Inc., Honeywell Scanning and Mobility, a global supplier of data collection and management solutions for in-premises, mobile and wireless applications. From March 2012 until joining the Company, Mr. Jerabeck served as Director, Quality Assurance, and, from May 2011 through September 2012, he led the integration of the EMS Global Tracking and LXE businesses acquired by Honeywell Scanning and Mobility. |

(5) | Mr. Lynch separated from the Company on September 1, 2015. Mr. Lynch had served as President of two of the Company’s wholly owned subsidiaries in the Company’s Government business segment, PAR Government Systems Corporation and Rome Research Corporation since January 2008. |

(6) | Mr. Malone separated from the Company on March 31, 2015 to pursue another opportunity. Mr. Malone, a Certified Public Accountant, was named Vice President and Chief Accounting Officer of the Company in May 2012.Mr. Malone held these positions concurrently with the position of Controller, ParTech, Inc. a position he held since August 2014 and Corporate Controller, a position he held from June 2010 through December 31, 2014. Mr. Malone joined the Company in May 2009 as the Director of Financial Analysis and Planning. |

CORPORATE GOVERNANCE

As provided by the By-Laws of the Company, as amended, and the laws of the State of Delaware, the Company’s state of incorporation, the business of the Company is under the general direction of the Board. The Board is comprised of six non-management directors and one management director.

Director Independence. The Board of Directors has affirmatively determined that four of the non-management directors (Directors Eurek, Foley, Russo and Tyler) are “independent” under the listing standards of the

New York Stock Exchange (“NYSE”),NYSE and meets the

Company’s Standardsadditional independence standards of

Independence, and pursuantthe NYSE with respect to the

Company’s Corporate Governance Guidelines. Prior to his departure from the Board

in May 2015, former Director John S. Barsanti was affirmatively determined by the Board to also meet these independence standards. In order to assist the Board in making this determination, the Board has adopted standards of independence as part of the Company’s Corporate Governance Guidelines,committees on which

he or she serves. Our independent directors are

available on the Company’s website at https://www.partech.com/wp-content/uploads/2015/12/PAR_Corp_Gov_Guidelines-as-Amended-12-10-14.pdf. The standardsidentified in the

Corporate Governance Guidelines identify, among other things, material business, charitable and other relationships that could interfere with a director’s ability to exercise independent judgment. During 2015, there were no transactions, relationships or arrangements between the Company and Directors Eurek, Russo or Tyler or anytable on page 5 of their respective immediate family members or entities with which they are affiliated. Dr. Foley, through his consulting firm, Martingale Consulting, served as a consultant to the Company from April 25, 2012 through December 8, 2015. In no twelve month period during the last three years did Dr. Foley receive compensation from the Company that totaled or exceeded $120,000. During 2015, Dr. Foley received compensation in connection with this consulting relationship totaling $80,000. This consulting relationship with Martingale Consulting ceased in December 2015 and, during 2015, there were no other transactions, relationships or arrangements between the Company and Director Foley or any of his immediate family members or entities with which his is affiliated. During 2015, there were no transactions, relationships or arrangements between the Company and former Director Barsanti or any of his immediate family members or entities with which his is affiliated. There are no family relationships between Directors Eurek, Foley, Russo or Tyler and any of the Company’s executive officers (“Executive Officers”). The Executive Officers serve at the discretion of the Board.proxy statement.

Board Meetings and Attendance. In 2015,Attendance. During the 12-month period ended December 31, 2021, the Board held 20 meetings and the standing Committees of the Board held a total of 1317 meetings. Each director attended at least 75% of the aggregate of all meetings of the Board and the committees on which they served. It ishe or she served during the Company’s policy to encourageportion of 2021 for which he or she was a director or committee member. The Company encourages directors to attend the Annual Meetingannual meetings of Shareholdersstockholders, but such attendance is not required. Last year, one memberThree of the Boardour directors who served during 2021 attended the Annual Meeting2021 annual meeting of Shareholders.

Board Leadership Structure. Since 2013, the Company’s By-Laws provide for the separation of the position of Chairman of the Board from the office of Chief Executive Officer. In 2015, former Director Barsanti servedStructure. James C. Stoffel currently serves as Chairman of the Board and PresidingLead Director of the independents until the expiration of his term on May 28, 2015. Following the 2015 Annual Meeting of Shareholders, the Board did not elect a Chairman of the Board but placed the leadership of the Board with Director Russo who was electedour Board. As Lead Director, and whoMr. Stoffel performs the function of the Chairman of the Board. The Board has determinedbelieves that the separation ofseparating the roles of Lead Director and Chief Executive Officer is appropriate for the Company asbecause it enables theour Chief Executive Officer to focus more closely on the day to dayday-to-day operations of the Company while theour Lead Director provides independent leadership to the Board. As a result,Our Lead Director’s independence uniquely situates him to represent the Board believes a non-executive Lead Director enables the leaderinterests of the Company’s Board to better represent shareholder interestsour stockholders and provide independent evaluation of and oversight of our management. He presides over all Board meetings, including executive sessions without the presence of management. The Board also believes that such separation is consistentHe regularly communicates with best practices of corporate governance of a publicly traded company. The independent directors have also designated Director Russo as the independent lead or Presiding Director with broad authorityour Chief Executive Officer and responsibility. During 2015, Presiding Director Barsanti scheduled and presided at one executive session of theliaisons between our non-management directors and one executive session of the independent Directors without any management, directors or employees present. Presiding Director Russo scheduled and presided over one executive session of the independent Directors without any management directors or employees present. The respective Presiding Directors communicated with theincluding our Chief Executive Officer, to provide feedbackhelp ensure that our non-management directors are fully informed and recommendations ofable to discuss and debate among themselves and with management the independent directors.issues that they deem important.

Board Oversight of Risk Management. TheManagement. Our Board is responsible fordoes not have a separate risk management committee; rather the full Board manages the risk oversight function, with certain areas addressed by committees of risk management. As part of its meetings in 2015, the Board dedicated timewhere such risks are inherent in a committee’s purview. In particular, our Audit Committee oversees our guidelines, policies and processes established by management relating to reviewour financial statements and discuss with management specific risk topics in detail. In addition, the Board held four meetings in 2015 for a comprehensive review with management of each of the Company’s business segments to discuss existing and potential strategic and operational risks. Follow up with the Board was conducted as appropriate.financial reporting processes. The Audit Committee oversees the Company’s risk policiesinternal audit function and processes relating to themeets regularly with senior management and our independent auditors concerning our financial statements and financial reporting processes, including our internal controlscontrol over financial reporting. The Company’s Internal Audit function reports directly to the Audit Committee and the Committee meets regularly with the Company’s management and independent public accounting firm regarding these mattersreporting and the effectiveness of such controlsprocesses and processes.controls. The Audit Committee regularly reports on such mattersmeets with management to discuss and assess management’s guidelines and policies with respect to risk assessment and risk management and our major financial risk exposures, including the nature and level of risk appropriate for the Company and management’s strategies and mitigation efforts. The Audit Committee, typically in joint session with the full Board.

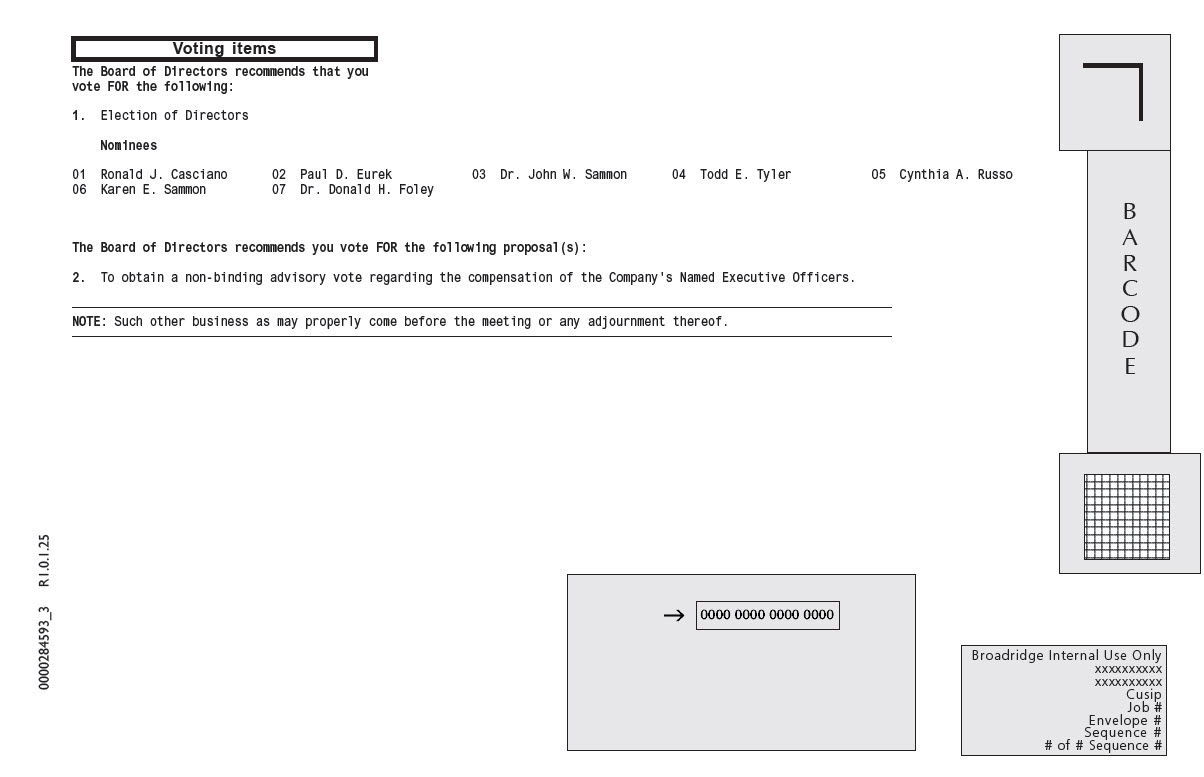

Committees. The Board, has three standing committees: Audit; Compensation;regularly meets and Nominating/Corporate Governance. Pursuant to the Company’s By-Laws, the Board may designate members of the Board to constitute such other committees as the Board may determine to be appropriate.receives reports from our cybersecurity, information technology and compliance groups regarding our systems, data security and compliance with legal and regulatory matters. The members of each of the three standing committees and the number of meetings held by each committee in 2015 are set forth in the following table.

| | Name | Audit | Compensation | Nominating & Corporate Governance |

| | Meetings Held in 2015 | 4 | 6 | 3 |

| | Members | | | |

| | Paul D. Eurek | X | Chair | X |

| | Dr. Donald H. Foley (1) | X | X | X |

| | Cynthia A. Russo (2) | Chair | X | X |

| | Todd E. Tyler | X | X | Chair |

| (1) | The effective dates of Director Foley’s committee assignments coincide with the date of his appointment to the Board effective January 1, 2016. |

| (2) | The effective dates of Director Russo’s committee assignments coincide with the date of her election to the Board on May 28, 2015. Prior to May 28, 2015, the committee assignments currently held by Director Russo were held by former Director John S. Barsanti. |

Audit Committee. In accordance with its charter, the Audit Committee assists the Board inalso has oversight of the Company’s accounting and financial reporting processes, systems of internal control, the audit process of the Company’s financial statements, and the Company’s processes for monitoring compliance with applicable laws and regulations as well as the Company’s code of ethics and conduct. The New York Stock Exchange (“NYSE”) and the Committee’s charter require the Audit Committee to consist of a minimum of three members, each of whom has been determined by the Board to meet the independence standards adopted by the Board. The standards adopted by the Board incorporate the independence requirements of the NYSE Corporate Governance Standards and the independence requirements set forth by the SEC. The Board has determined each of the members of the Audit Committee (including any member who has stepped down during 2015) and the current members of the Audit Committee to be “independent” as this term is defined by the NYSE in its listing standards, meet SEC standards for independence of audit committee members and no member of the Audit Committee has a material relationship with the Company that would render that member not to be “independent”. The NYSE and the Committee’s charter require all members of the Committee to be financially literate at the time of their appointment to the Committee, or within a reasonable time thereafter. The Board has determined that all members of the Audit Committee are financially literate and the Chair of the Committee, Director Russo, and Director Tyler are each an “audit committee financial expert”, as defined by the SEC. The number of meetings of the Audit Committee indicated in the table above includes meetings held separately with management, the Company’s Internal Audit function, the independent public accounting firm, as well as separate executive sessions with only independent directors present. The Report of the Audit Committee begins on page 11 of this Proxy Statement.

Compensation Committee. The Committee’s charter requires the Compensation Committee to be comprised of a minimum of three independent directors. The present Committee is comprised of four members. The Board has determined that each of the members of the Committee has met the independence standards adopted by the Board which incorporate the independence requirements of NYSE listing standards even though these rules are not applicable to smaller reporting companies. Meeting as needed, the Compensation Committee reviews and approves corporate goals and objectives relevant to the compensation of the Company’s Chief Executive Officer, evaluates performance in light of those goals and objectives and determines and approves the compensation level (including any long-term compensation components) and benefits based on this evaluation. In addition, the recommendations of the Chief Executive Officer regarding the compensation, benefits, stock grants, stock options and incentive plans for all Executive Officers of the Company are subject to the review and approval of the Compensation Committee.related party transactions. Our NCGC focuses on risks associated with our corporate governance policies and practices and environmental, social and governance (“ESG”) matters.

Code of Conduct. Our Code of Conduct (the “Code of Conduct”) is applicable to all our employees, officers, and directors, including our Chief Executive Officer, Chief Financial Officer, other senior financial officers and other executive officers. The Compensation Committee also reviews and makes recommendationsCode of Conduct is posted on our website at www.partech.com/investor-relations/. Any substantive amendments to the Board regardingCode of Conduct or waivers granted to our directors, Chief Executive Officer, Chief Financial Officer, other senior financial officers or other executive officers will be disclosed by posting on our website.

Hedging Transactions. Our Compliance Handbook, which applies to all our employees, officers and directors prohibits hedging or monetization transactions in our securities, including through the leveluse of financial instruments such as prepaid variable forwards, equity swaps, collars and formexchange funds that permit holders to own our securities without the full risks and rewards of compensation for non-employee directors in connectionownership.

Corporate Governance Guidelines. Our Corporate Governance Guidelines are posted on our website at www.partech.com/ investor-relations/. Our Corporate Governance Guidelines contain independence standards, which are substantially similar to and consistent with service onthe listing standards of the NYSE, and policies relating to our corporate governance. These guidelines are reviewed no less frequently than annually by the Board and its committees.

In 2015 the Committee did not engage any independent compensation consultant, choosing to utilize purchased survey data more fully described in the compensation discussion under the heading Executive Compensation commencing on page 17 of this document.

Nominating/Corporate Governance Committee. PursuantNCGC and, to the NYSE listing standards all membersextent deemed appropriate in light of the Nominating/Corporate Governance Committee are independent. Pursuant to its charter a minimum of three independent directors must constitute the Nominating/Corporate Governance Committee. The present Committee is comprised of four members. The Board has determined that each of the members of the Nominating/Corporate Governance Committee has met the independence standards adopted by the Board which incorporate the independence requirements of NYSE listing standards. The Nominating and Corporate Governance Committee assists the Board in meeting its responsibilities to:

| · | identify and recommend qualified nominees for election to the Board |

| · | develop and recommend to the Board a set of corporate governance principles, as set forth in the Company’s Corporate Governance Guidelines; |

| · | maintain the corporate code of ethics and conduct as set forth in the Company’s Code of Business Conduct and Ethics; and |

| · | monitor the compliance with, and periodically review and make recommendations to the Board regarding the Company’s governance. |

Committee Charters. The Board of Directors has approved the charters under which the Audit, Compensation, and Nominating/Corporate Governance Committees operate. These charters are reviewed regularly by the respective committees, which may recommend appropriate changes foremerging practices, revised accordingly, upon approval by the Board. Copies of the charters for the Audit, Compensation, and Nominating/Corporate Governance Committees are posted on the Company’s website and a printed copy of these documents may be obtained without charge by written request. Requests can be made via the internet or by mail. The respective website and address for making such requests for printed copies of these and other available documents may be found under the heading “Available Information” on page 29 of this Proxy Statement.

Presiding Director and Executive Sessions. The independent directors have chosen Director Russo to preside at regularly scheduled executive sessions of the independent directors during 2015 and during 2016 until the Annual Meeting. Prior to expiration of his term on May 28, 2015, this role was filled by former Director John S. Barsanti. Among their duties and responsibilities in this capacity, the respective Presiding Directors chaired and had the authority to call and schedule Executive Sessions of the non-management directors and the independent directors. The Presiding Director communicated with the Chief Executive Officer and the Board to provide feedback and recommendations of the independent directors. The independent directors met in executive session with only independent directors being present a total of two times during 2015.

Communication with the Board. The Board avails itself to communications from the Company’s shareholders.. Interested parties may send written communication to the Board as a group, the independent directors as a group, the PresidingLead Director (James C. Stoffel), or to any individual director by